Serving you face-to-face in Hyderabad, India, or Virtually across the globe.

5 Years of Quality Service in Finance

At Shah Financial, we help bring clarity to your understanding of the financial world through our financial planning process. We work to prepare you for important decisions that will help grow, preserve, protect and transfer the assets you have worked a lifetime to accumulate. Most importantly, there is a culture of independence here. One that is focused on the individual. We understand that you and your financial needs are unique.

Comprehensive Financial Consultancy of Family Finances

Includes all financial goals consultancy including children’s future, retirement, etc…

Retirement Consultancy (Accumulation & Distribution)

Includes end-to-end consultancy, handholding and for Retirement.

Insurance Portfolio Consultancy

Includes analysis and restructuring of existing life and health insurance policies based on actual needs of client.

Investment Portfolio Consultancy

Includes analysis and restructuring of the existing investment portfolio of mutual funds, insurance etc…

Children’s Future Consultancy

Includes end-to-end consultancy towards ensuring all children’s goals like education, higher education,etc..

House Purchase Consultancy

Includes total cost analysis, Rent Vs. Buy analysis, Home Eligibility checking, Plan for Down-payment.

Who We Are

At Shah Financial, we take the time to understand you and your goals. So you receive a comprehensive set of wealth solutions that address your specific preferences and needs.

We are there to help you achieve your goals. As a client of Shah Financial, you will work with a company with deep resources, a reputation for putting the interests of clients ahead of our own and a passion for helping transform the lives of the people we serve.

- Identify you Goals

- Personalize Your Plans

- Monitor Progress

- Reach Success

WHY CHOOSE US

Client-Centered

At our firm, the client always comes first. We are in this business to serve others and make a positive impact on their lives. Read More..

Comprehensive Advice

When creating your financial strategies, we address your entire financial picture, from your short-term and immediate needs to your long-term goals. Read More..

Independent

As an independent firm, we are not confined to proprietary products or sales quotas. Rather than focus on selling products. Read More..

WHAT OUR CLIENTS SAY

Your ROle

Shah Financial wants each client to make the most of their financial products and services. As client, your role is to provide us with accurate information about your financial and personal situation, know your financial options, rights, and obligations, and keep your personal information accurate and up-to-date.

-

05

Years Experience

-

150

Happy Customers

-

100%

Satisfaction

LATEST POSTS

The Realities of Relying on Corporate Health Insurance

“I have corporate health insurance of ₹5 lakhs from my office. What’s the need for personal health insurance?” This is a common question many people have, especially when their employers provide a substantial health cover. However, relying solely on corporate health insurance might not be the best strategy for long-term financial security. 🏢 What is

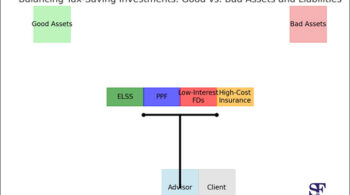

Investments Solely for Tax Savings: A Double-Edged Sword?

Investments Solely for Tax Savings: A Double-Edged Sword? When it comes to tax-saving investments, it’s essential to differentiate between creating assets and liabilities. The choices you make under Section 80C of the Income Tax Act can either enhance your financial health or burden you with low-yield, high-cost commitments. Equity-Linked Savings Scheme (ELSS) vs. PPF vs.

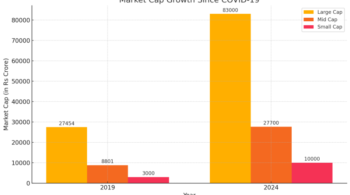

The Rise of Large, Mid, and Small Cap Companies Since COVID-19

Introduction The stock market has experienced significant changes since the onset of the COVID-19 pandemic. Market capitalizations (mcaps) of companies have surged, reflecting a broader economic recovery and investor optimism. Here, we delve into how the classifications of large, mid, and small-cap companies have evolved since 2019. Large Cap Companies Before the pandemic, the cutoff