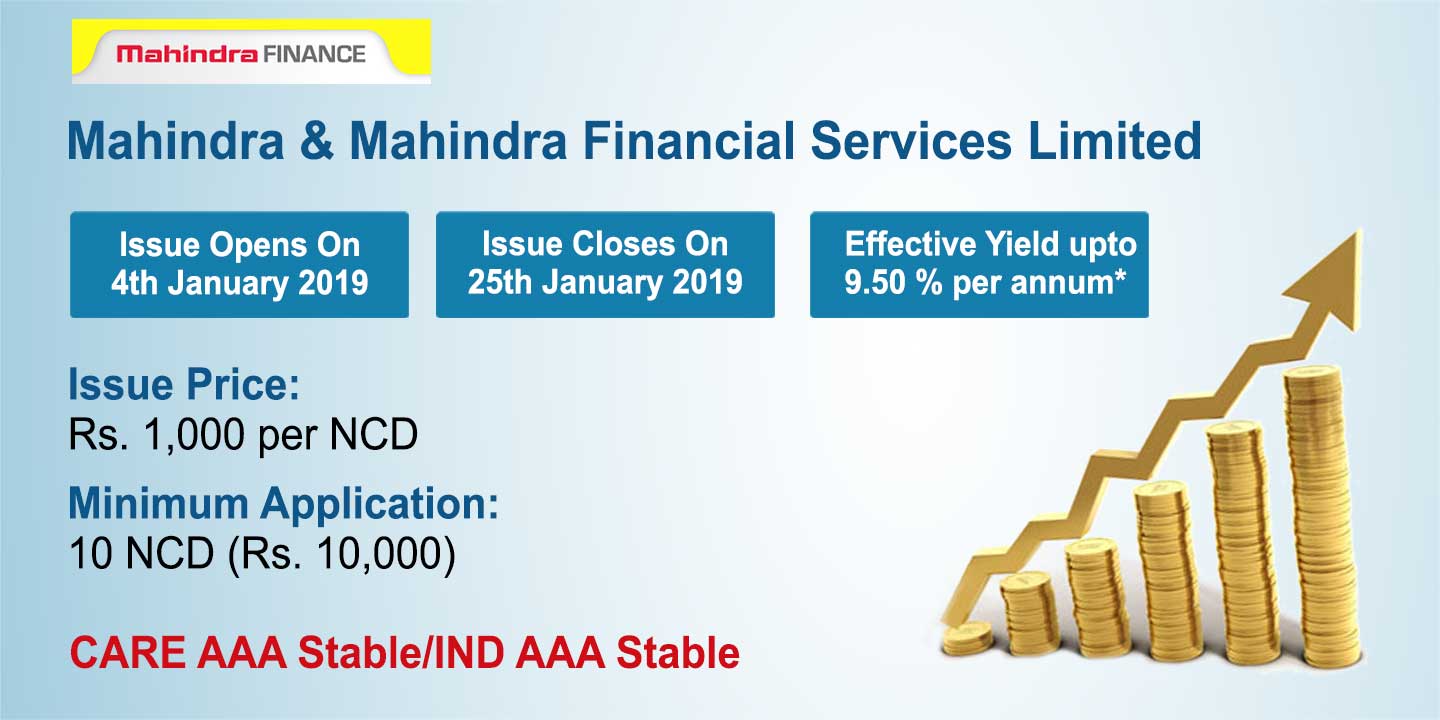

Mahindra & Mahindra Financial Services Limited scheduling its Secured, Rated, Listed Redeemable Non covertible debentures from January 4, 2019 – Januray 25, 2019 having Base Issue Rs.150 Crore with an option to retain over subscription up to Rs.150 Crore aggregating to overall Issue size of Rs.300 Crores.

Mahindra & Mahindra Financial Services Limited scheduling its Secured, Rated, Listed Redeemable Non covertible debentures from January 4, 2019 – Januray 25, 2019 having Base Issue Rs.150 Crore with an option to retain over subscription up to Rs.150 Crore aggregating to overall Issue size of Rs.300 Crores.

Summary Of Issue:

| Issuer:- | Mahindra & Mahindra Financial Services Limited |

| Issue Open | January 4, 2019 – Januray 25, 2019 |

| Total issue Size | Base Issue Size: ₹ 500 crore with an option to retain oversubscription up to ₹ 3000 Crs aggregating up to ₹ 3500 Crs |

| Face Value | Rs. 1,000 Per NCD |

| Nature of Instrument | Secured and/ or Unsecured Subordinated,Redeemable, Non-Convertible Debentures |

| Minimum Application size | Rs.10,000/- ( 10 NCDs) |

| Credit Ratings | ‘CARE AAA; Stable’ by CARE and “IND AAA; Stable” by India Ratings |

| Listing | BSE |

| Basis of Allotment | “First come First Serve” Basis |

| Interest on application money | As all Applications are being made under ASBA where Application Amount is blocked in the ASBA Account, no interest shall be payable on Application Amount in this Issue. |

Company Profile: The Company was incorporated in 1991 under the name of Maxi Motors Financial Services Limited as a public limited company under the provisions of the Companies Act 1956. The Company was registered as a deposit-taking NBFC in 1998 and have since established a pan-India presence, spanning 27 states and five union territories through 1,296 offices as of 30 September 2018. It caters to the financing needs of retail customers and small and medium-sized enterprises. The Company primarily focus on providing financing for purchases of auto and utility vehicles, tractors, cars, commercial vehicles and construction equipment, pre-owned vehicles, and others which accounted for 26 %, 18 %, 20 %, 13 %, 23% and 9 % of estimated total value of the assets financed by the Company, respectively, for the financial year 2018. For the half-year ended 30 September 2018, financing for purchases of auto and utility vehicles; tractors; cars; commercial vehicles and construction equipment; and pre-owned vehicles, SME and others accounted for 23%, 18%, 20%, 18% and 21% of estimated total value of the assets financed by the Company. They benefit from their close relationships with dealers and their long-standing relationships with OEMs, which allow them to provide on-site financing at dealerships.

Financial Performance:

Profit Details in Lakhs

| Particulars | 31st March’2018 | 31st March’2017 | 31st March’2016 |

| Total Income | 857349.67 | 720065.08 | 659744.99 |

| Profit Before Tax(PBT) | 166173.65 | 83775.45 | 122411.98 |

| Profit After Tax( PAT) | 102391.13 | 51163.67 | 77229.36 |

| Earning Per Share(Basic in INR) | 17.62 | 9.06 | 13.29 |

Mahindra & Mahindra Financial Services Limited

What to look for in NCDs

- Before investing in NCDs, investors must see if they are secured or unsecured. In secured ones, they are backed by assets. Which means, if the company is unable to fulfil its obligations, the assets of the company will be liquidated to repay investors. On the other hand, unsecured ones are not backed by any assets. So, if the company is in financial trouble, there can be an issue in paying back the bond holders. As a result, unsecured NCDs pay higher coupons than secured ones.

- While companies issue NCDs to raise long-term funds, these debentures cannot be converted into shares or equities. All NCDs issued have to rated and it is always advisable to buy those papers which have highest rating. Ideally, one should invest in NCDs till maturity for higher long-term returns and reduce the re-investment interest rate risk.

- After maturity, the investor gets back the principal invested and the interest accumulated, if one opts for cumulative option. The company gets back its debenture. The listed debentures are treated as long-term capital assets if the non-convertible debentures are held for a period of 12 months. Investors must keep in mind that while NCDs offer good returns, they also carry higher default risks compared to bank or postal deposits. Moreover, they are very liquid unlike these deposits.

Companies do not deduct tax at source (TDS) on the interest earned every year if NCDs are held in demat form. In fact, any security issued by a company in a demat form and is listed on any recognised stock exchange in the country does not come under the TDS ambit. However, one has to declare the interest amount as income from other source at the time of filing tax returns and pay tax accordingly.

Income Tax on NCDs:

For Tax Purpose NCDs are treated as Debt Investment (similar to FD). The interest earned is added to your income as “income from other sources” and taxed accordingly.

Capital Gains Tax on NCD:

In case the NCD is sold before maturity on stock exchanges, it would lead to Capital Gains and taxed according to the holding period.

- If the NCD was sold within 12 months of allotment, it leads to Short Term Capital Gains and

- if the selling period is more than 12 months its Long Term Capital Gains

- Short Term Capital Gains would be added to income and taxed accordingly

- Long term capital Gains would be taxed at the flat rate of 10% (u/s 112 of IT Act)

TDS on NCD:

There is no TDS (Tax deduction at Source) deduction for NCD held in Demat form, while in case of NCD held in Physical Form, TDS would be deducted if the annual interest payout is more than Rs 5,000.

Should you Invest:

- The credit rating is AAA stable which is good for investment purpose,

- NCDs are relatively safer assets than Stocks and Mutual Funds but they are riskier than bank FDs and Government bonds. NCD Issuers normally do not default but when things go drastically wrong, they may face problem in paying the investors.

- NCD Issuers, especially the top business groups(in this case Mahindra & Mahindra), normally do not default but when things go drastically wrong, they may face problem in paying the investors. In such a scenario, secured NCD holders (if any) would be given higher priority than the holders of Subordinated NCDs.

- Do not invest your entire savings or investible surplus in one NCD issue alone.You may consider other alternative fixed income avenues like Debt oriented Mutual Funds, Hybrid Mutual Funds, Post office MIS scheme, PPF, Post office Senior Citizen Savings Scheme,etc.

Recommendation:

- My recommendation is to invest some part of your Fixed Income investment in this NCD Issue (3/ 5/8 year tenure bonds only),

- You should always have diversified portfolio be it fixed deposit, NCD or equity investment,

- It will be a good idea to remain invested till maturity because liquidity on exchanges is low and hence you would get lower than market value

NHAI is soon coming up with its maiden public issue of taxable bonds for the retail investors. It has already filed its draft shelf prospectus with SEBI on November 16, 2018, so the issue is expected to open in the month of December’2018.

NHAI is soon coming up with its maiden public issue of taxable bonds for the retail investors. It has already filed its draft shelf prospectus with SEBI on November 16, 2018, so the issue is expected to open in the month of December’2018.