This is for education purpose and the story is made up to simplify the concept, don’t take it at face value.

Lets say I am a Real Estate developer, K Raheja. I like a land in Mumbai & Hyderabad for some commercial development. I decide to buy it. Where will I get the funds to buy & construct it?

-

Self

-

Bank, NBFC, MF – Debt

-

Partner – someone else investing as Equity

So I invest some funds, got some from banks & MF’s & I also got Blackrock to invest to buy the land & make the business park called Mindspace. I constructed around 23-mn sq ft with multiple building & I started leasing them out to companies who wanted rented office premises.

There comes a point where I needed more funds to build new building (6.4 mn sq ft), pay off the loans etc., where do I get the funds? So I decide to do an IPO. Not of the entire company K Raheja but only this project called Mindspace. So I formed a trust or corporation.

I committed to payout 90% of my rent income to the shareholders proportionately as dividends & I will use this money to invest a minimum 80% in completed real estate, which is generating rent and will use 20% in constructing new Real Estate.

Is the IPO a win-win?

-

K Raheja gets more money 2 pay off debt, investment in more commercial real estate.

-

Investors will receive dividends semi annually (from the rent income) which is tax free + as its listed on the exchange the stock prices can go up.

Why will the stock price go up?

-

Rents increase year after year

-

The value of the land increases

-

New construction means more business.

Why invest in a REIT?

-

G-Sec is at 6% and the rent yield in commercial RE is 7.5%-8%

-

Diversification – It’s a combination of Debt (rent income) & Equity (listed so prices can move)

-

Investment in RE with just 50K.

Tax Structure?

There are 3 types of income,

-

Rent–Tax-free

-

Interest – REIT’s can also loan money to another developer (maximum 20%) & receive interest. If you receive interest from the REIT, It will be taxed at the slab rate. Practically this is very less or zero.

-

Capital Gain on the stock exchange – 15% Short Term Capital Gains Tax if you sell the REIT before 3 years and 10% Long Term Capital Gains Tax if you sell the REIT units after 3 years.

-

Capital Gain on the stock exchange – 15% Short Term Capital Gains Tax if you sell the REIT before 3 years and 10% Long Term Capital Gains Tax if you sell the REIT units after 3 years.

What to look for before investing in a REIT?

-

Weighted Average Lease Expiry – Higher the better

-

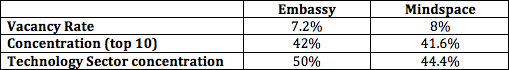

Vacancy Rate – Lower the better

-

Concentration of top 10 tenants – Lower the better

-

Sector Concentration – Lower the better.

REITs operate exactly like MF’s

-

Sponsor – K Raheja and Blackstone

-

Manager – K Raheja (receives AMC fees for managing the properties)

-

Trustee

But

REITs and real estate mutual funds are not the same.

Disclaimer: This is not investment advice.

Source: Kirtan A Shah, you can reach him on his twitter handle @kirtan0810