Aug

Tata Capital Financial Services Ltd is coming with the 2nd tranche of public issue of secured, redeemable non-convertible debentures of face value of Rs 1,000 each, up to Rs 2997.9 crore and Unsecured, Subordinated, Redeemable, Non-Convertible Debentures of face value of Rs 1,000 each (“Unsecured NCDs”) up to Rs 1128.1 crore aggregating upto Rs 4126 crore (“Tranche II Issue”). The base issue size of tranche II issue is Rs 500 crore with an option to retain oversubscription upto Rs 3626 crore, aggregating upto Rs 4126 crore (“Residual Shelf Limit”).

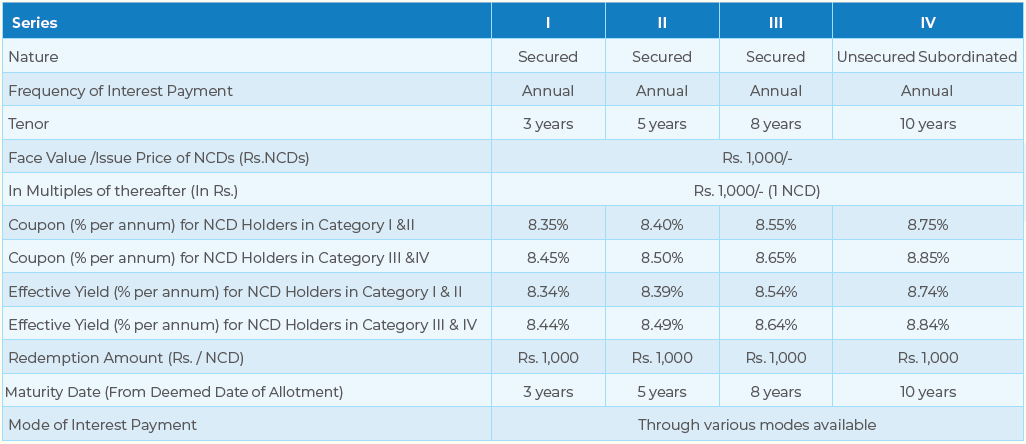

The issue will open for subscription from August 13, 2019 to August 23, 2019 (The Issue shall remain open for subscription during the period indicated above except that the Issue may close on such earlier date or extended date as may be decided by Board of Directors of the Company (“Board”) or the Working Committee). The company will be paying an interest ranging between 8.35% and 8.85% p.a. on these bonds.

The proposed NCDs issue has been rated ‘CRISIL AAA/Stable’ by CRISIL and CARE AAA; Stable by CARE Ratings Limited. Instruments with this rating indicates highest degree of safety regarding timely servicing of financial obligations. Such instruments carry very low credit risk.

Objects of the Issue: TCFSL proposes to utilise the funds which are being raised through the Tranche II Issue, after deducting the Tranche II Issue related expenses to the extent payable by TCFSL (“Net Proceeds”), towards funding the following objects (collectively, referred to herein as the “Objects”):

- For the purpose of onward lending, financing, and for repayment /prepayment of interest and principal of existing borrowings of TCFSL; (atleast 75%); and;

- General Corporate Purposes (upto 25%)

Issue Details

| Issuer | Tata Capital Financial Services Limited |

| Issue Size | Public issue of secured, redeemable non-convertible debentures of face value of Rs 1,000 each, up to Rs 2997.9 crore and Unsecured,Subordinated, Redeemable, Non-Convertible Debentures of face value of Rs 1,000 each (“Unsecured NCDs”) up to Rs 1128.1 crore aggregating upto Rs 4126 crore (“Tranche II Issue”). The base issue size of tranche II issue is Rs 500 crore with an option to retain over subscription upto Rs 3626 crore, aggregating upto Rs 4126 crore (“Residual Shelf Limit”). |

| Issue opens | Tuesday , 13th August 2019 |

| Issue closes | Friday , 23rd August 2019 |

| Allotment | First Come First Serve Basis, Compulsory in demat form |

| Face Value | Rs 1000 per NCD |

| Issue Price | Rs 1000 per NCD |

| Nature of Instrument | Secured Redeemable Non-Convertible Debentures and Unsecured Subordinated Redeemable Non-Convertible Debentures eligible for inclusion as Tier II capital. |

| Minimum Application | Rs 10,000 (10 NCDs) collectively across all Options and in multiple of Rs 1,000 (1 NCD) thereafter across all Options |

| Listing | NCDs are proposed to be listed on BSE and NSE |

| Rating | ‘CRISIL AAA/Stable’ by CRISIL CARE AAA; Stable by CARE Limited |

| Security and Asset Cover | The principal amount of the Secured NCDs to be issued in terms of the Tranche II Issue together with all interest due on the Secured NCDs, as well as all costs, charges, all fees, remuneration of Debenture Trustee and expenses payable in respect thereof shall be secured by way of first ranking pari passu charge on the identified immovable property and on identified book debts, loans and advances, and receivables, both present and future, of TCFSL. TCFSL has created the security for the Secured NCDs in favour of the Debenture Trustee for the NCD Holders on the assets to ensure 100% security cover of the amount outstanding in respect of the Secured NCDs, including interest thereon, at any time. |

Allocation Ratio

| Institutional Portion | Non-Institutional Portion | High Net Worth Individual Portion | Retail Individual Investor Portion |

| 15% of the Overall Issue Size | 15% of the Overall Issue Size | 35% of the Overall Issue Size | 35% of the Overall Issue Size |

Credit Rating:

The NCDs proposed to be issued under this Tranche II Issue have been rated “CRISIL AAA / Stable” for an amount of upto Rs 7,50,000 lakh by CRISIL Limited vide its letter dated August 15, 2018, revalidated vide its letter dated August 27, 2018 and further revalidated by letter dated July 25, 2019, and have been rated “CARE AAA; Stable” for an amount upto Rs 7,50,000 lakh by CARE Ratings Limited vide its letter dated August 14, 2018, revalidated vide its letter dated August 27, 2018 and further revalidated by letter dated July 26, 2019. The ratings of the NCDs issued by CRISIL Limited indicate highest degree of safety regarding timely servicing of financial obligations.

Liquidity and Exit Options: The Bonds are proposed to be listed on the BSE and NSE

Allotments in case of over subscription: In case of an over subscription in a category, allotments to the maximum extent, as possible, will be made on a first-come first serve basis in that category and thereafter on proportionate basis, i.e. full allotment of the Secured NCDs to the Applicants on a first come first basis up to the date falling 1 (one) day prior to the date of over subscription and proportionate allotment of Secured NCDs to the applicants on the date of over subscription (based on the date of

upload of each Application on the electronic platform of the Stock Exchange, in each Portion)

Company Background:

Tata Capital Financial Service Ltd is a Systemically Important Non – Deposit taking Non – Banking Financial Company (“ND – SI – NBFC”) focused on providing a broad suite of financing products customized to cater the needs of various segments. It has a robust marketing and distribution network which provides customers a diversified financial services platform with presence in 23 states through 125 offices as on June 30, 2019. Its financing products include:

Corporate finance: The Corporate Finance Division (“CFD”) offers commercial finance which offers vanilla term loans, working capital term loans, channel finance, bill discounting, construction equipment finance, leasing solutions, lease rental discounting, promoter finance and structured products. In addition, the Special Assets Management Group (“SAMG”) was formed to manage the project finance portfolio of the erstwhile infrastructure finance division;

Consumer finance: The Consumer Finance and Advisory Business Division (“CFABD”) offers a wide range of consumer loans such as car and two wheeler loans, commercial vehicle loans, tractor loans, business loans, loans against property, personal loans, consumer durable loans and loans against securities;

Additionally, it has launched Tata cards, which are white label credit cards that enable customers to earn and redeem points across Tata group partners and offers convenient payment options in the form of EMIs. TCFSL is promoted by and is a wholly owned subsidiary of Tata Capital Ltd. (TCL), which is a diversified financial services company providing services through its subsidiaries to retail, corporate and institutional clients. TCL is the financial services arm of the Tata group, which is a diversified global business group serving a wide range of customers across varied sectors such as steel, motors, power, chemicals, telecommunications and hospitality.

TCFSL’s total income (Consolidated) and profit after tax from continuing operations of the Company (Consolidated) for the year ended March 31, 2019 stood at Rs 5,585.66 crore and Rs 432.81 crore respectively. The loan outstanding of the Company stood at Rs 44,623.97 crore as on March 31, 2019. The CRAR, as of March 31, 2019 computed on the basis of applicable RBI requirements was 16.84% compared to the RBI stipulated minimum requirement of 15% as per the Prudential Norms of RBI. The gross NPAs and net NPAs as a percentage of total loan and advances outstanding was 2.45% and 0.39% respectively as of March 31, 2019.

Key Operational and Financial Parameters:

| Parameters | Fiscal 2019 (as on March 2019) (Ind AS) (Rs in Cr) |

| Net worth | 5,723.11 |

| Total borrowings of which | 39,805.66 |

| i) Debt Securities | 16,091.48 |

| ii) Borrowings (other than debt securities) | 20,416.58 |

| iii) Subordinated liabilities | 3,297.60 |

| Property, plant and equipment | 914.87 |

| Capital work in progress | 0.62 |

| Intangible assets under development | 1.08 |

| Other intangible assets | 21.79 |

| Financial assets | 45,058.96 |

| Non-financial assets | 1,208.64 |

| Cash and cash equivalents | 251.63 |

| Bank balance other than above | 0.36 |

| Investments | 381.59 |

| Financial liabilities | 2,046.24 |

| Non-Financial liabilities | 1,942.74 |

| Total income | 5,585.66 |

| Revenue from operations | 5,529.68 |

| Finance cost | 3,125.01 |

| Impairment on financial instruments | 451.53 |

| Profit for the year from continuing operations | 432.81 |

| Total Comprehensive Income | 428.55 |

| Gross NPA (%) | 2.45 |

| Net NPA (%) | 0.39 |

| Tier I Capital Adequacy Ratio (%) | 12.11 |

| Tier II Capital Adequacy Ratio (%) | 4.73 |

Competitive Strengths of the company

- Integrated financial services platform

- Diversified and balanced mix of businesses

- Robust internal processes and risk management framework

- Synergy and parentage of Tata group

- Widespread operational network

- Strong and experienced management team

- Strategy

- Consolidate existing lines of business

- Explore new business opportunities

- Leverage technology advantage

- Expand client base and geographical presence

- Attain and retain talented professionals

Key Risks and Concerns:

- Fluctuation in interest rate;

- Inability to sustain growth or manage it effectively;

- Inability to successfully diversify portfolio;

- Any disruption in sources of funding;

- Inability to recover on a timely basis the full value of collateral amount which are sufficient to cover the outstanding amounts due under defaulted loans;

- Highly competitive nature of the industry TCFSL operates in;

- Changing laws and regulations governing the banking and financial services industry in India;

- Inability to obtain or maintain statutory or regulatory approvals and licenses for conducting business; and

- Inability to continue to benefit from relationship with Promoter and the “Tata” brand.