Introduction

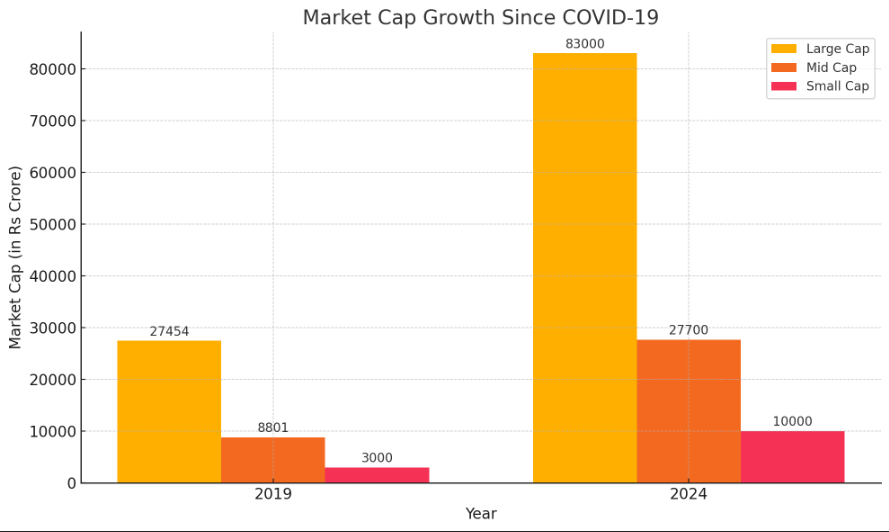

The stock market has experienced significant changes since the onset of the COVID-19 pandemic. Market capitalizations (mcaps) of companies have surged, reflecting a broader economic recovery and investor optimism. Here, we delve into how the classifications of large, mid, and small-cap companies have evolved since 2019.

Large Cap Companies

Large Cap Companies

Before the pandemic, the cutoff for large-cap companies was around Rs 27,454 crore. Fast forward to mid-2024, and this threshold has surged to over Rs 83,000 crore. This sharp increase signifies how the upper echelon of the stock market has expanded, with more companies achieving higher valuations.

Mid Cap Companies

Mid-cap companies have also seen a substantial rise in their cutoff, moving from Rs 8,801 crore in 2019 to approximately Rs 27,700 crore. This threefold increase highlights the growth and resilience of medium-sized enterprises, which are increasingly attracting investor interest.

Small Cap Companies

While the article doesn’t detail the specific figures for small-cap cutoffs, it’s clear that the bottom tier of the stock market has also expanded. As the market grows, smaller companies are pushing higher into the mid-cap range, reshaping the investment landscape.

Industry Insights

The Association of Mutual Funds in India (Amfi) revises the market cap classifications biannually. The adjustments reflect the previous six months’ average market caps, ensuring that the classifications stay relevant amidst dynamic market conditions. Analysts suggest that expanding the large and mid-cap universes could provide fund managers with more flexibility to outperform benchmarks.

Conclusion

The post-COVID era has seen a dramatic shift in market caps across the board. Large, mid, and small-cap companies are growing, reflecting broader economic trends and increased investor confidence. Keeping abreast of these changes is crucial for making informed investment decisions.

Source: Business Standard