Elections Round Up

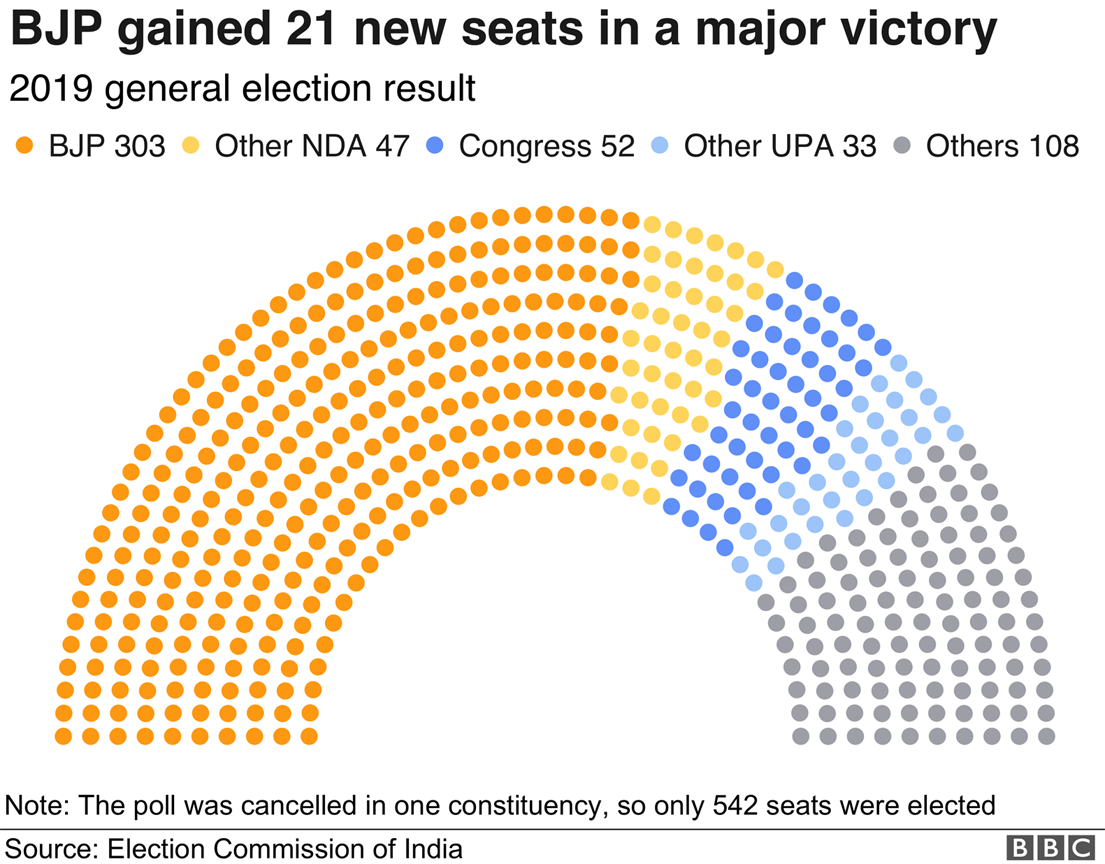

The BJP led NDA government returned to power with a clear majority, a feat last achieved by Indira Gandhi in the late 1970s. The ruling coalition will now control 65% of the lower house. This coupled with a near majority in the upper house sets the stage for further reforms and policy action. From a market point of view, the election results have added to the attractiveness of India as an investment destination. The market is likely to view the return of the Modi government extremely positively; We expect the government to announce further economic and governance reforms over the next few months.

Five Years – Pain to Glory

Modi Government 1.0 took several policy actions with a long gestation period. This was possible due to the majority mandate in 2014. The results in 2019 are a reaffirmation of these policies. We expect the government to continue with tough policy changes in the coming years in the build up to 2022 (India’s 75th year of independence). The government is likely to have a multi-pronged approach addressing issues in infrastructure, employment and business reform. The primary objective will remain to bring growth back on track while stabilizing the economy.

Expectations

With a return to power, the markets expect round 2 of political and economic reform. We believe these reforms will be stepping stones to stronger and a more sustainable economic growth that balances the benefits between the social sector and the private sector.

Economy

A strong mandate is likely to see a rerun of strong reformist policy action. Our analysis of the current macro-economic environment points to 3 major stresses

Infrastructure Development

While the last 5 years saw a resurgence is infrastructure execution, a lot more needs to be done. Impetus on social issues across health, sanitation and education are likely to lead the way for more investment in infrastructure and allied sectors.

Tight Liquidity

The issues with NBFC’s and the liquidity in the economy continue to plague lending across the sector severely affecting consumption and growth. Steps by the RBI and the Finance ministry to alleviate these problems will be a priority to stabilize the economy.

Jobs Growth

The growth in the economy over the last five years was driven largely by jobless growth. Furthermore, sectors like auto, auto ancillaries and industrial manufacturing which are typically large job creators. The budget will also be a good platform to aid key sectors of the economy.

PSU Bank Recapitalization

The government is likely to take concrete steps to improve the health of the banking sector through bank consolidations and adequately capitalizing banks currently in the PCA framework. The aim will be to kick start the credit cycle through formalized lending through public sector banks.

Business Reform

GST – While we believe the benefits of GST will fructify over the next 18-24 months, implementation of invoice matching and extension of e-way clearances are likely to streamline tax collection operations and minimize slippages in the system. Further simplification of GST rates will also reduce the cost of compliance especially small business owners.

Fixing the Insolvency & Bankruptcy Code (IBC )Process – Despite its implementation in 2016, the IBC has seen limited success in resolving large bankruptcy cases. Further tightening in the litigation process will likely speed up bank recoveries and free much needed capital for the banking sector.

Challenges – Global Factors

Given, India is a largely oil import dependent economy, oil will play a key role in the fortunes of the country. Oil below US$70/barrel will be positive for the economy. Global political uncertainty will also have a bearing on the economy.

How to Play the Markets?

Equity Markets

The election results are a extremely positive for the Indian equity markets, however longer term structural changes will take time and hence investors should continue to exercise caution while deploying fresh funds at this juncture. Earnings recovery is still a couple of quarters away and hence participation in a phased manner through SIP and STP route would be ideal to ride out the inherent volatility in the current markets.

Given our focus on quality and are bias towards fundamentally sound business models, the big trend we are looking to play is the corporate deleveraging(reducing loans) and operational efficiency(reducing cost) story that is unravelling.

On Mid and small caps, we believe opportunities have emerged post the steep corrections. Companies with well-defined niches and strong moats are likely to deliver above average returns within the wider mid and small cap basket. Tactical investment opportunities can be looked at in the current market environment.

Source: Axis MF