In a world full of uncertainties—from geopolitical tensions to economic fluctuations—investors must focus on both value creation and value protection. The wisdom of legendary investor Warren Buffett has never been more relevant:

“Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1.”

India’s vibrant economy offers numerous opportunities across sectors and market capitalizations. Whether you’re looking at the stability of large-cap stocks or the explosive potential of small caps, micro caps, and SMEs, the Indian market provides a dynamic landscape for wealth building. But when market volatility strikes, the emphasis often shifts from creating value to preserving wealth. Successful investing lies in balancing the pursuit of growth with safeguarding what you’ve built.

Value Creation: Tapping into India’s Growth Potential:

Value creation is all about identifying and investing in assets that have the potential to appreciate over time. A classic approach is value investing—buying securities that are temporarily undervalued by the market due to short-term issues or overreactions. This requires a keen understanding of market trends and economic indicators that signal growth opportunities.

The primary goal here is growth—finding stocks, bonds, or other investments that can increase in value based on strong business fundamentals, market positioning, or innovative offerings.

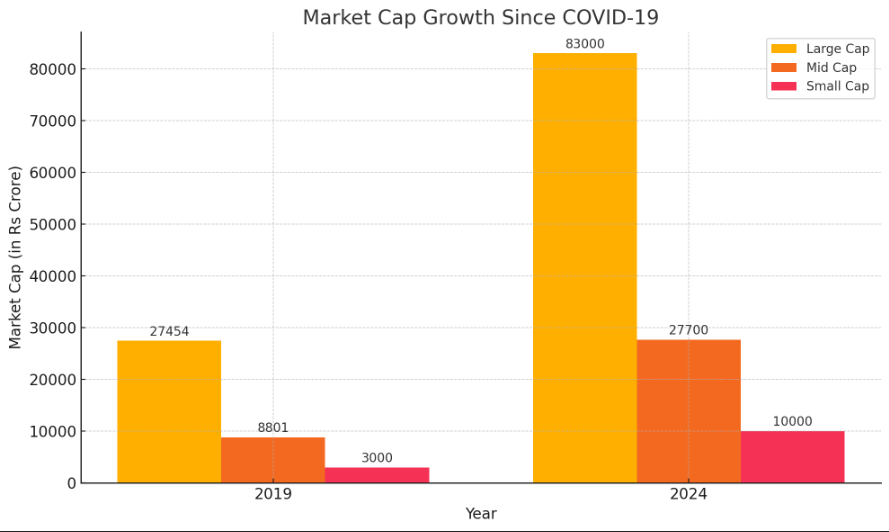

“The size anomaly” in the Indian market is particularly interesting. Smaller stocks tend to outperform larger ones over time. This is a phenomenon seen globally, but it’s especially persistent in India. Over the last five years, the Nifty MidSmallcap 400 and Nifty Microcap 250 indices have posted impressive returns of 32.45% and 44.62%, respectively. Factors like market inefficiencies and information asymmetry in smaller companies can work to the advantage of investors who do their homework.

That said, while smaller stocks may seem attractive now, some sectors may appear overvalued. It’s crucial to prioritize companies with strong earnings visibility and reasonable valuations. In volatile markets, sticking to long-term fundamentals will help you weather frequent sector rotations.

Investors keen on SMEs should be strategic. Rather than chasing momentum or short-term gains, focus on SMEs with solid fundamentals, resilient business models, and growth potential. Key factors include profitability, cash flow management, competitive positioning, and market potential.

In terms of sectors, fintech, e-commerce, renewable energy, and biotechnology represent the future of the Indian economy. While startups in India are promising, they’re often still expensive and speculative investments. For most investors, traditional avenues like mutual funds and equities offer more reliable paths to wealth creation. High fees in venture capital and private equity funds also make startup investments less accessible.

Value Protection: Safeguarding Your Wealth:

While creating value is important, protecting your wealth is equally crucial—especially during times of economic uncertainty and market volatility.

- Large-cap Stability: Focus on blue-chip companies with consistent earnings, strong balance sheets, and a history of increasing dividend payouts. These form the backbone of a stable portfolio. Prioritize companies with low debt-to-equity ratios and strong cash flows—they are better equipped to handle downturns. For instance, companies like Tata Consultancy Services (TCS), which have minimal debt, offer a solid foundation.

- Diversification: This remains a timeless strategy. By spreading your investments across asset classes, sectors, and geographies, you can mitigate risk. A well-balanced portfolio combining large-cap and small-cap investments can offer both growth and stability.

- Defensive Sectors: Investing in sectors like consumer staples, utilities, and healthcare can provide stability during downturns. These sectors are less affected by economic cycles and offer stable earnings and dividends, making them a safe choice for conservative investors or those nearing retirement.

- Commodities: In times of inflation and currency devaluation, gold has historically been a reliable hedge. Gold isn’t just a tradition in India; it’s a proven store of value during market turbulence. Options like physical gold, ETFs, or Sovereign Gold Bonds (SGBs) offer easy exposure.

- Global Market Exposure: Accessing global markets gives you exposure to industries and sectors not available domestically, reducing portfolio risk by diversifying geographically. It also allows for currency diversification, enhancing the potential for both value creation and protection. Through the Liberalized Remittance Scheme (LRS), Indian investors can easily access global markets.

Striking the Balance: Growth and Stability

The art of balancing value creation and protection is an ongoing process that requires regular review and adjustment. This approach ensures that your portfolio aligns with your risk tolerance and financial goals, especially in uncertain times.

As Warren Buffett wisely reminds us: “The goal is not just to make money, but to never lose it.”

Your financial journey is a marathon, not a sprint. With the right blend of growth and stability, you are well-positioned to thrive not just in India’s growth story but in your financial future as well.

Here’s to your continued financial success!