When it comes to Health Insurance, most people focus on the sum insured – believing a ₹5 lakh or ₹10 lakh policy is enough to cover major medical expenses. However, a lesser-known clause called the room rent limit can significantly reduce how much your insurer will pay leaving you with a hefty out-of-pocket bill.

In this blog, we’ll break down:

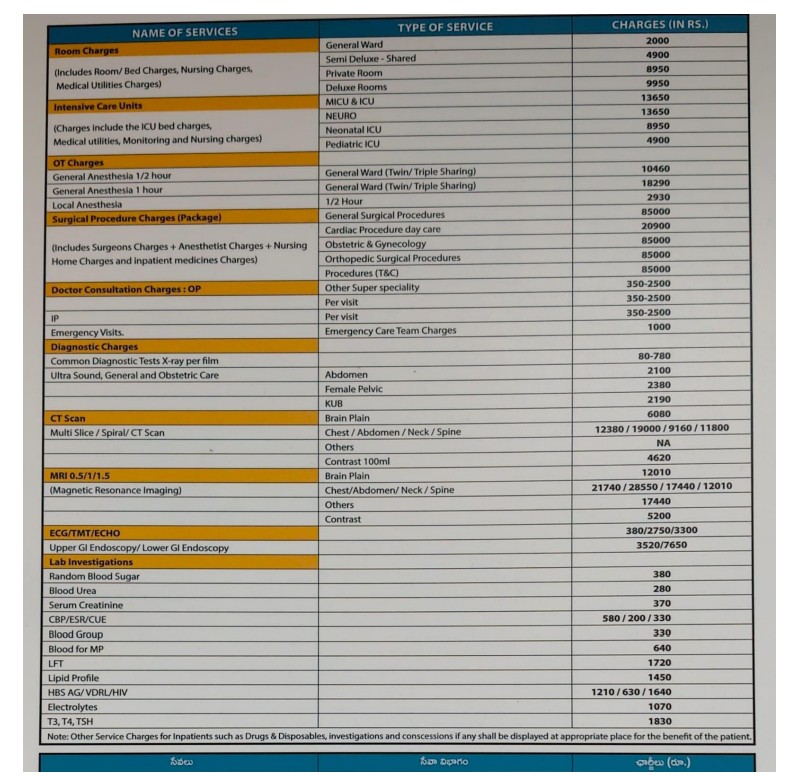

- Why hospitals charge different rates for the same service?

- How room rent limits work and their impact on your claim?

- How to avoid unpleasant surprises when filing a claim?

Why Do Hospitals Charge Different Rates for the Same Service?

Did you know that the same doctor’s visit or surgery can cost drastically different amounts depending on the hospital room you choose?

For example, in many hospitals:

A doctor’s visit in a shared room may cost ₹1,000–₹2,000

The same doctor’s visit in a suite can cost ₹2,500 or more

Similarly, operation theatre charges, diagnostic tests, and daily care costs vary depending on your room category—even if the medical procedure itself is identical.

For insurers, this poses a significant challenge. Without limits, a policyholder opting for a luxury room could drive up the overall treatment cost. This is why insurers introduce room rent limits as a way to manage claim payouts

Understanding Room Rent Limits in Health Insurance:

A room rent limit is the maximum daily amount your insurer will pay for a hospital room.

This limit is typically defined as a percentage of your sum insured—commonly:

- 1% of the sum insured for regular hospitalization (e.g., ₹5,000/day for a ₹5 lakh policy

- 2% of the sum insured for ICU stays (e.g., ₹10,000/day for a ₹5 lakh policy)

- If you choose a hospital room that exceeds this limit, your insurance won’t just exclude the extra room cost – it applies proportionate deductions to your entire bill.

How Proportionate Deduction Works (With an Example)

Let’s say Mr. X has a health insurance policy with:

- Sum insured: ₹10 lakhs

- Room rent limit: ₹2,000 per day

Mr. X is hospitalized and chooses a private room that costs ₹8,000/day. Over a 5-day stay, his total bill comes to ₹2 lakhs.

Since the allowed room rent is ₹2,000/day but the actual room cost is ₹8,000/day, the insurer applies a proportionate deduction:

Sum Approved = (Room Rent Approved / Room Rent Claimed) × Total Bill

- Sum Approved = (₹2,000 / ₹8,000) × ₹2,00,000

- Mr. X’s Approved Claim = ₹50,000

Even though his sum insured is ₹10 lakhs, Mr. X must pay ₹1.5 lakhs from his own pocket— just because of the room rent limit.

Why Room Rent Limits Can Be Costly

Room rent limits don’t just restrict the room you can select – they also reduce all related expenses such as:

➢ Surgeon’s fees

➢ Doctor’s visits

➢ Operation theatre charges

➢ Diagnostic tests

If your room exceeds the specified limit, every component of your bill is reduced proportionately leaving you exposed to significant out-of-pocket expenses.

How to Protect Yourself from Room Rent Limits

- Choose a Policy with No Room Rent Limit:

Many comprehensive health insurance plans now offer “No Room Rent Capping” – ensuring you can select any room without worrying about proportionate deductions. - Review Your Existing Policy:

Check your policy document for terms like “room rent limit” or “room category capping.” If your policy includes this restriction, consider upgrading to a no-cap plan. - Port to a Better Plan:

If your current insurer doesn’t offer a no-limit option, port your policy to a more flexible plan at the time of renewal without losing continuity benefits. - Understand Sub-Limits:

Room rent isn’t the only restriction—watch for disease-specific limits (e.g., caps on maternity or cataract costs) which can also impact your claims. - Speak to a Financial Advisor:

Consult an expert who can guide you to the best health insurance plan, ensuring you’re covered for large hospital bills without unexpected deductions.

Final Thoughts:

Room rent limits are one of the most overlooked pitfalls in health insurance. While they may seem like a small technicality, they can slash your eligible claim—leaving you with a significant financial burden during a medical emergency.

Invest in a policy with no room rent limit to ensure you and your loved ones get the best medical care without compromising on quality due to hidden clauses.

If you want help evaluating or upgrading your health insurance plan, reach out to us today – because when it comes to your health, there should be no compromises.