Jul

Investments Solely for Tax Savings: A Double-Edged Sword?

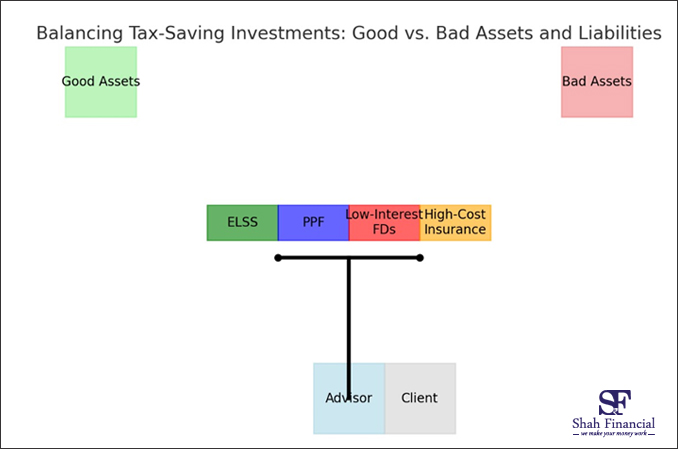

When it comes to tax-saving investments, it’s essential to differentiate between creating assets and liabilities. The choices you make under Section 80C of the Income Tax Act can either enhance your financial health or burden you with low-yield, high-cost commitments.

Equity-Linked Savings Scheme (ELSS) vs. PPF vs. Low-Interest Fixed Deposits vs. High-Cost Insurance Policies:

Equity-Linked Savings Scheme (ELSS):

- Pros: ELSS funds offer the dual benefit of tax savings and potential for high returns due to equity exposure. They have a relatively short lock-in period of three years.

- Cons: The risk associated with equity markets might not be suitable for all investors.

Public Provident Fund (PPF):

- Pros: PPF is a government-backed, long-term investment with tax benefits on the invested amount, interest earned, and maturity proceeds. It’s safe and reliable, with decent returns.

- Cons: The 15-year lock-in period might be too long for some investors.

Low-Interest Fixed Deposits:

- Pros: These offer safety and assured returns, suitable for risk-averse investors.

- Cons: The returns are often low and may not keep up with inflation, making them less effective in wealth creation.

High-Cost Insurance Policies:

- Pros: Some insurance policies provide a combination of insurance and investment benefits.

- Cons: The high cost and low returns on the investment component often make them less attractive compared to other options.

Insurance: Asset or Liability?

Insurance can be both an asset and a liability, depending on the policy type and terms. Policies with cash value or those protecting significant assets can be valuable. However, if premiums are high without adequate coverage, it becomes a liability.

Good Insurance:

- Provides adequate, cost-effective coverage.

- Protects against significant financial risks.

- Policies with a cash value component can act as an asset.

Bad Insurance:

- Offers inadequate coverage.

- Comes at an unreasonable cost.

Understanding Good and Bad Assets:

Bad Assets:

- Definition: Investments that do not generate income or appreciate and often require more money to maintain.

- Examples: Depreciating assets like cars and electronics, non-performing loans, unproductive real estate.

- Key Characteristics: Negative cash flow, high opportunity cost, financial risk.

Good Liabilities:

- Definition: Debts used to finance investments or assets that generate income or appreciate.

- Examples: Mortgages on rental properties, business loans, controlled leveraged investing.

- Benefits:Facilitate financial growth, enhance wealth, potentially tax-deductible

Strategic Financial Decisions:

Making informed decisions about assets and liabilities is crucial for financial health and long-term success. While bad assets can drain resources, good liabilities can be leveraged to create wealth.

Government Perspective:

- Good Assets:Infrastructure, education, healthcare, research and development.

- Bad Assets: White elephant projects.

Conclusion:

Investing wisely under Section 80C involves evaluating potential returns, risks, and alignment with financial goals. By making strategic decisions, you can transform potential liabilities into powerful tools for wealth creation, laying the foundation for a prosperous future.

Takeaways for Investors:

-

Evaluate investments carefully: Consider their potential to generate income or appreciate.|

-

Leverage wisely:Use debt for investments with solid returns.

-

Monitor cash flow: Ensure investments contribute positively.

-

Seek professional advice: Work with a financial planner to tailor strategies to your goals.

Informed choices today lay the foundation for a prosperous tomorrow. Make strategic decisions to harness the power of assets and liabilities for wealth creation.