Apr

Are you wondering whether to break your old Fixed Deposit (FD) to invest in a new one with higher interest rates? It’s a common dilemma that many people face.

Before you make any decision, it’s essential to calculate the penalty and the interest rates for both the old and new FDs to determine if it’s financially beneficial. Let’s break down the concept with an example:

Suppose you have an old FD of INR 1,00,000 for 1 year at an interest rate of 6% per annum. At maturity, you will receive INR 1,06,000 (which includes INR 6,000 as interest earned).

Now, you have the option to break your old FD after 6 months and invest the money in a new FD with a higher interest rate of 7% per annum for the remaining 6 months.

However, breaking your old FD will incur a penalty of 1% (INR 1,000). So, should you break your old FD and invest in a new one?

To make an informed decision, you need to compare the total returns from both scenarios.

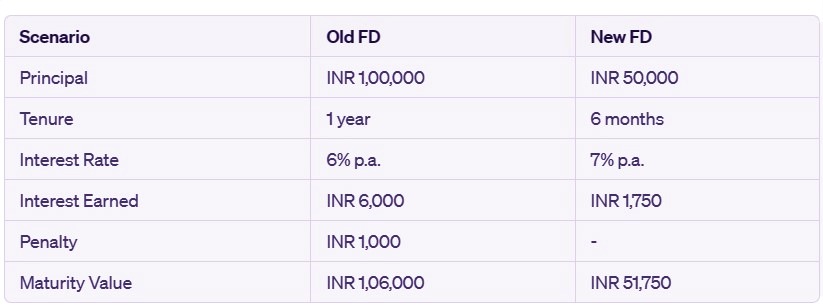

Here’s a table to help you calculate:

From the table, we can see that if you keep your old FD, you’ll earn INR 6,000 as interest, but if you break it and invest in a new FD, you’ll earn INR 1,750 as interest and incur a penalty of INR 1,000.

Therefore, in this case, it’s not financially beneficial to break your old FD and invest in a new one. However, if the penalty for premature withdrawal is lower, or the difference in interest rates is higher, it may be worthwhile to break your old FD and invest in a new one.

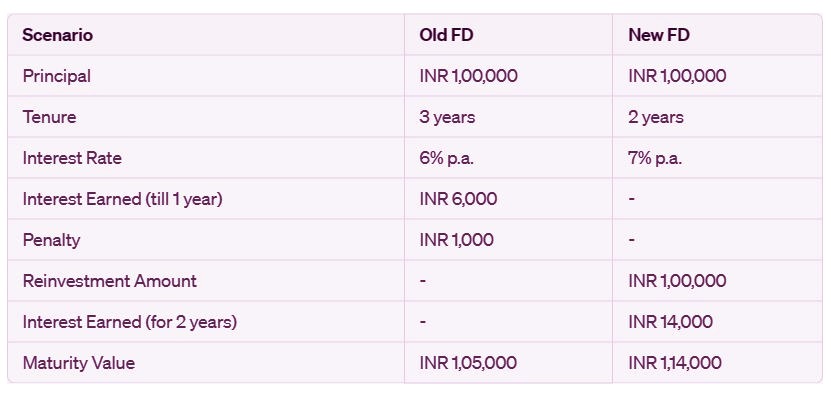

Let’s take another scenario for a person who has an FD of INR 1,00,000 for a tenor of 3 years with an interest rate of 6% p.a. and is considering breaking the FD after 1 year with a penal rate of 1%:

From the table, we can see that if the person breaks the FD after 1 year, they will receive INR 1,05,000, which includes INR 6,000 as interest earned till 1 year and a penalty of INR 1,000.

On the other hand, if the person reinvests the amount in a new FD with a higher interest rate of 7% p.a. for 2 years, the maturity value after 2 years will be INR 1,14,000, which includes INR 14,000 as interest earned for 2 years.

Therefore, in this case, it may be financially beneficial to break the old FD and reinvest the amount in a new one with a higher interest rate, provided the person is willing to pay the penalty of 1% on the amount.

However, it’s important to note that the decision to break an FD should not be taken lightly, and the person should carefully evaluate the penalty charges, the difference in interest rates, and the duration of the new FD before making a decision.