FMP (or Fixed Maturity Plan) is a closed-ended debt mutual fund.

Unlike other open-ended debt funds, FMPs are not available for subscription on a continuous basis.A close-ended debt fund that invests for a specific period of time and has low risk.

The fund house comes up with a New Fund Offer (NFO) for a specific duration. NFO will have an opening date and a closing date. You may invest in the NFO only during these days. After the closing date, the offer to invest ceases to exist.

Such a fund invests only in instruments whose duration is similar to its own term i.e., it aligns its term with that of its underlying assets.

These FMP NFOs are generally open for 2 to 3 days and are marketed to corporate and well-heeled, high net-worth individuals. Nevertheless, the minimum investment is usually Rs 5,000 and so a retail investor can comfortably invest too.

Investors looking for a debt exposure in their portfolio generally opt for traditional debt instruments like Bank FDs (Fixed Deposits), Bonds, NSC (National Savings Certificates), Post Office, etc. Very few investors are aware that these are not the most tax-efficient investment avenues. The income from these sources is fully taxable (except PPF and PF) and hence the real return (after tax) is often lower than the prevailing rate of inflation.

How is FMP different from other debt funds?

Unlike other debt funds, the fund manager of FMP follows a buy and hold strategy. There is no frequent buying and selling of debt securities like other debt funds. This helps to keep the expense ratio of FMPs at lower level vis-a-vis other debt funds.

FMPs Vs FDs

Being a debt instrument, FMPs and FDs are similar in many ways. Both require you to stay invested for a fixed duration. Both of them are available in varying maturities to suit your convenience.

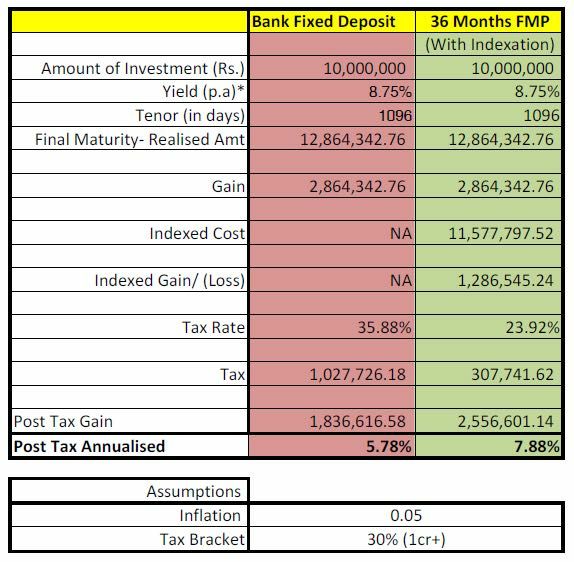

However, FMPs are a stark contrast to FDs when you look at it from a returns perspective. Unlike the guaranteed returns that reflect on the FD certificate, FMPs offer an indicative yield – the returns offered by FMPs are not assured but indicative in nature. It means that there is a chance of the actual returns being higher or lower than the returns indicated during the NFO launch. Please see the table below to understand this better.

|

Parameter |

FMP | FD |

|---|---|---|

| Returns | Indicative Returns | Assured Returns |

| Tax | 1. Dividend Option – DDT tax 2. Growth Option – Tax on capital gains |

Interest earned is added to your income, and the income is taxed accordingly |

| Liquidity | Restricted liquidity | Ease of premature redemption, higher liquidity |

Please find below example ..how FMPs are tax efficient compared to FD’s in above three years of duration:

So which is a better option: FMPs or FDS?

Fixed maturity plans perfectly cater to individuals as well as corporate houses. They have the twin advantage of higher returns plus tax efficiency.The coupon rates of bonds have moved up but FD rates have remained low. In such a scenario, locking into high quality (AAA-rated) portfolio of FMPs can deliver superior returns to FDs.

Resources: Clear Tax, Jago Investor.